- #Phone number to lift equifax security freeze how to

- #Phone number to lift equifax security freeze password

- #Phone number to lift equifax security freeze free

I finally got a document indicating the freeze was in place and there was a credit file number. The next best way to talk to their customer support . While 71 is Experian’s best toll-free number, there are 11 total ways to get in touch with them. If you need help with anything related to your membership account with Experian, you should call the company’s customer service at (866) 617- . The first question the automated system will ask you for your social security number.How Do I Reach a Real Person at Experian? – Amy Northard 6 Check Your Credit Report & Credit Score – Equifax.

#Phone number to lift equifax security freeze how to

5 How to Freeze your Credit + Who to call (useful phone numbers).4 Talk to Live Person at Equifax, Experian, TransUnion.3 Experian Phone Number | Call Now & Skip the Wait – GetHuman.2 How to Contact a Credit Bureau and Talk to a Real Person.1 How Do I Reach a Real Person at Experian? – Amy Northard.It also tracks your SSN, scans the dark web, sends you automatic alerts from two credit bureaus and more-all for free.

#Phone number to lift equifax security freeze free

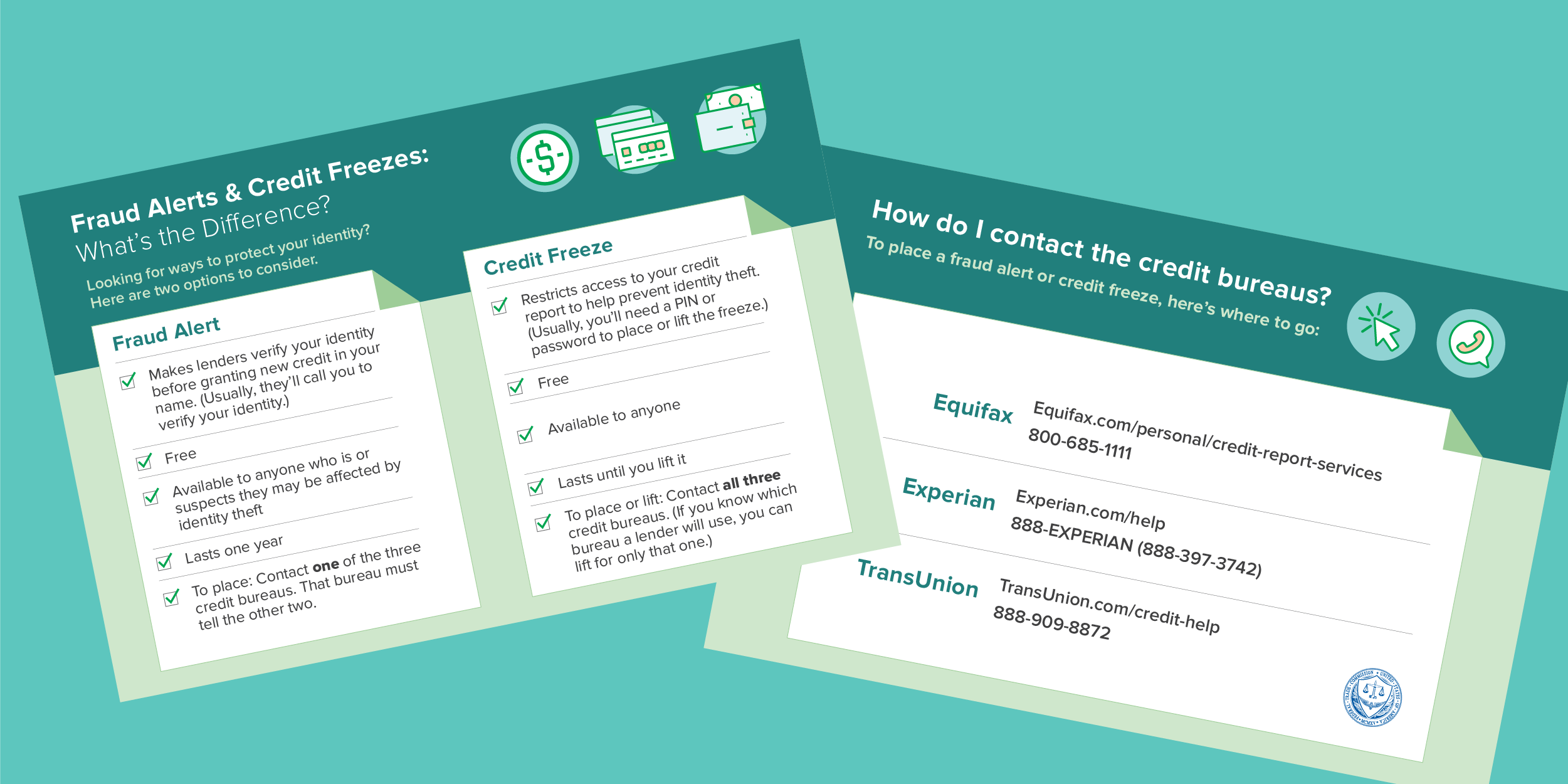

And you can also get a free TransUnion credit report from CreditWise from Capital One.ĬreditWise is a free tool that allows you to monitor your TransUnion® VantageScore® 3.0 credit score. You can get free copies of your credit reports once a year from each of the major credit bureaus by visiting. You can get a sense of whether you may need to refreeze your credit at any point by keeping an eye on your credit reports and scores. How do you know if your credit needs to be refrozen? But in a few states, credit freezes may expire after seven years. In most cases, a credit freeze will last until you request to undo it. You just need to send a request to the credit reporting agency online or by phone or mail. You can unfreeze your credit at any time-even if you just froze it. How soon can you unfreeze credit after a freeze? None of the three major credit agencies charges a fee to unfreeze or freeze your credit. How much does it cost to unfreeze credit? If you request to unfreeze your credit by mail, you may have to wait for up to three days after the credit bureau receives your request for the change to happen. The timing for unfreezing credit by phone is similar to doing it online. But to be safe, you may need to wait up to an hour for the request to be processed. Once you have an account registered with that credit agency, you’ll be able to unfreeze your credit online almost instantly. How long does it take to unfreeze credit? If you know which bureau’s credit report a prospective lender will be looking at, it may be worth temporarily unfreezing that credit report alone. Just as it’s possible to freeze your credit reports individually, it’s also possible to unfreeze one report at a time. Do you need to unfreeze with all three credit bureaus? Here are some of the most frequently asked questions about unfreezing credit. You may have some additional questions about unfreezing your credit reports. Unlike fraud alerts, which only require you to contact one bureau, you have to get in touch with each credit bureau to unfreeze your credit. If you spoke with someone over the phone, try to remember if you had to use a PIN and what that PIN is.

#Phone number to lift equifax security freeze password

Once you’re ready to unfreeze your credit, it may help to think back to how you froze it initially.ĭid you do it online? If so, track down your login information and password and any other information you may have used. This could save you the hassle of unfreezing and refreezing your credit when you apply for a loan. If you froze your accounts as a precaution but you think all your accounts are secure, then it may make sense to permanently unfreeze your credit. You may schedule a thaw in advance if you know what dates you’ll need your credit freeze to be lifted. To thaw your credit, you can lift your credit freeze for a specific number of days to give lenders enough time to access your credit reports. If you froze your credit because you suspected or knew your personal information had been stolen or misused, then you may only want to unfreeze your credit temporarily. If you’re looking to unfreeze your credit, you can usually do so either temporarily or permanently.

0 kommentar(er)

0 kommentar(er)